Managing Derivative Risks, Chew

Chapter

6

Option Risks: Curvature and Time Decay

by: Mark Glitto

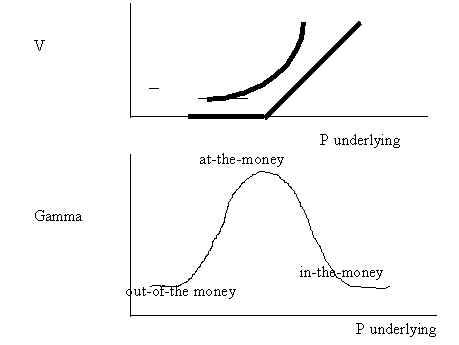

The non--linear price profile of options is the first sign that we are venturing into unfamiliar territory. The curvature of options is dynamic as opposed to the relatively stable convexity of bonds and some forward-based instruments.

Gamma (Convexity) Risk

The rate at which delta changes is called Gamma. Remember that delta is the rate of change in the options price for a given move in the price of the underlying. Gamma is also known as convexity or curvature, and all three are used interchangeably. Delta and gamma can be thought of as two facets of a derivatives price sensitivity just as speed and acceleration are two aspects of how a car moves. Delta is like speed, it describes how fast the car is moving at a particular point in time. Gamma can be likened to acceleration because it describes the change in speed for a given change in time. Both speed and acceleration are functions of distance and time, but acceleration is derived from speed (thus it is termed a second-order effect). In the same way Gamma is derived from delta, but both are needed for a complete picture of an option's price behavior.

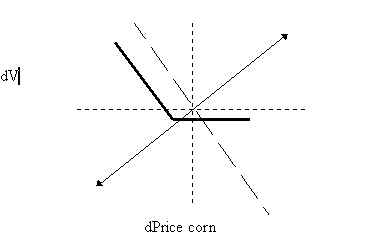

The serious problems of hedging delta are due more to an options gamma rather than its delta since it is the gamma of an option that brings about a new delta. Furthermore, gamma causes an option's delta to change like a chameleon, when market moves are large, making it almost a first order risk for options. Gamma not properly managed can cause a firm to lose considerable money.

Gamma defined: risk that results from options having dynamic price sensitivities i.e. deltas that change fluidly. The basis of this problem is that the option price changes in a non-liner way while the price of the underlying asset on which the option is priced moves linearly. So when an option seller uses the asset or forward instrument to hedge the option the option sell will find themselves seriously under or over-hedged as the underlying asset changes quickly. What the seller finds is that the hedge must be continuously adjusted

Note, underlying assets have zero Gamma since they change one-for-one with themselves.

Gamma Generalizations

A near-the-money option has a high gamma because the option's delta responds increasingly to price moves in the underlying; a small move has a huge impact on the probability of exercise. So an at-the-money option has the highest gamma since a small change in the price of the underlying will determine if the option is exercised or falls worthless.

A near-the-money and expiring soon has even higher gamma since it is even more probable that the underlying will be at the new level when the option expires. Again an at-the-money option that is expiring soon will have the highest gamma since even a the smallest price moves of the underlying have a huge impact on the options value.

A large gamma indicates a high degree of risk because the delta of the option will change more quickly than one with a small gamma. A high gama means that the option becomes unheadged easily.

Example:

A call option with a strike of 6% has three more days to run. LIBOR is currently at 6%. In the next three days if LIBOR moves down even two basis points to 5.98 the option is out of the money and expires worthless. But if LIBOR moves up by even one bases point to 6.01% the option expires in the money. The rate of change of delta in this case is dramatic. With gamma so high delta hedging this option is very problematic.

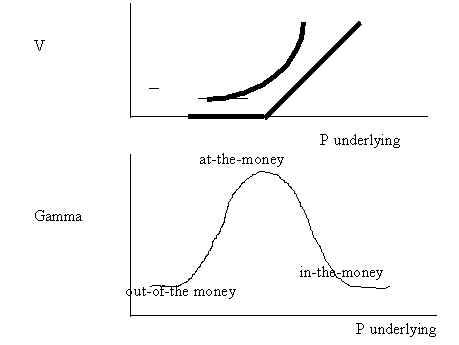

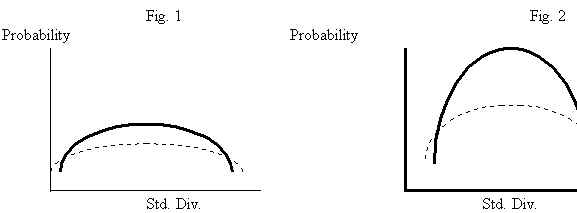

The Gamma Mountain

An option with a high gamma indicates that the option will resolve itself. A high gamma option will resolve itself more quickly than one with a low gamma because the former's delta will change faster. Think of it this way, delta indicates how much the option has resolved itself, and gamma shows the options drive to resolve itself. In the world of options uncertainty is directly related to volatility and the passage of time.

A gentle slop means low or reducing gamma a step slope means high or advancing gamma. An option with a few days left to expiration has a very high gamma, e.g. the slope in figure 2 is step. Remember large gamma means quick resolution. The high gamma in figure 2 shows that that option is going to quickly resolve itself to 0%,expire out-of-the money, or 100% expire in-the money.

Gamma versus Curvature

There is a subtle difference between gamma and curvature. Gamma measures the change in delta for one unit change in the underlying's price. This means that gamma is a local measure, giving the option user information about the options behavior at that point in time and for small market moves around that point in time. In this way gamma is local curvature and for small market moves may appear to be linear.

Curvature of an option is a broader measure. Curvature is the entire curved line showing how an option responds in a non-liner way to changes in the underlying prices. And the larger the price moves the larger the curvature. It is this broader picture of gamma that should concern option users.

Hedging Gamma

Gamma risks are best hedged by using instruments that have curvature, so options are the best hedge against other options - buying other options if you are short and selling other options if you are long The more closely the two options are matched the less chance you will have of an intervening event affecting one option and not the other. And in turn reducing the accuracy of your hedge.

Another problem is that some option markets are one way. For example, Brazilian bonds or Southeast equities. In the early 1990s the problem was that there were lots of buyers but no natural sellers, so if the sellers wanted to hedge with options, they could not find any. They were forced to delta hedge their options in the underlying cash markets.

What commonly happens is that the option seller must delta hedge until they find a party willing to sell them offsetting options. Even in developed markets dealers sell an option and delta hedge the spot exposure and shop around for an option that meats there exact hedging needs. The hedger might keep the delta hedge if they fell the market will be stable. This is problematic to me because it involves taking a view on the market, the problems of this were discussed in my last lecture.

Time Decay (Theta) Risk

The passage of time reduces uncertainty because as the option moves towards its expiry date we can see that it is going to resolve itself one way or the other.

Theta measures the effect on the options price of a one day decrease in the time to expiration. Because the life of an option can only decrease, the term 'time decay' is used to describe how the theoretical value of an option erodes with the passage of time. Since long-dated options have more time value than short date options, theta risk is more closely associated with short dated options. With short-dated options time decay is larger because the time value of the option is spread out over less days so each passing day represents a sizable chunk of its time value.