Replacement

Costs

Managing Financial Risk, Smithson & Smith

Chapter 17

Measuring and Managing Default Risk

by: Mark Glitto

From my lecture on swap transactions you will recall that we can use swap transaction to alter the risk profile of our firm. But when we enter into swaps or other derivative contracts we take on a new risk, credit risk, where there were none before. Once our firm takes on these additional risks we must manage them. Management of credit risk is especially important for a financial intermediary or dealer who manages a portfolio of derivative contracts.

With a forward contract either of parties might default. My lecture on futures gave three reasons futures reduce default exposure. First, the transaction is settled on a daily bases, second, margin requirements, and finally a clearinghouse imposes itself between the parties. As we have seen, a swap is a combination of forwards. The exposure on a plan vanilla swap is much less than on a loan because the principal is not at risk and the swap is in effect only a set of net interest payments.

Default risk is a function of essentially two factors: exposure and the probability of default.

Exposure

Traditional bank exposure is straight forward and easy to manage. The risk exposure is the amount of the loan, "the amount that walked out the bank" less any principal payments that have occurred. With derivative products, however, the bank is exposed to two types of risk. First, there is the current value of the derivative, or current exposure. This is the replacement value or mark-to-market value. This reflects the amount at risk if default occurs now.

But with derivatives, there are also potential changes in value. This reflects what might happen in the future. This is determined by possible future interest rate movements, the likelihood of the counter party defaulting, and a discount factor to reflect the time value of money.

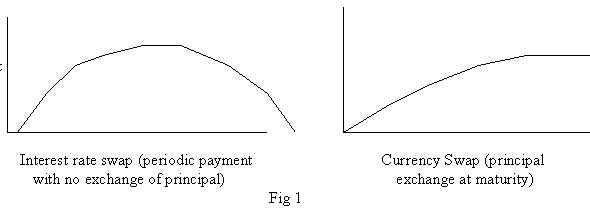

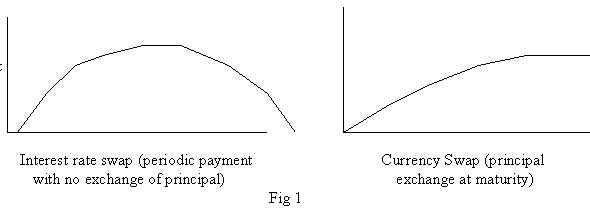

These exposures will change over the life of the transaction. The amortization effect reflects the fact that there is more exposure at the beginning of a transaction than at the end. The diffusion effect reflects the fact that the underlying can vary from its original value more, the longer the contract. Combining the two means that the greatest exposure tends to lie in the middle of the life of the contract for an interest rate swap. For a currency rate swap, however, the repayment of principal shifts more of the exposure to the end.

Expected

Replacement

Costs

Maximum vs Expected Exposure

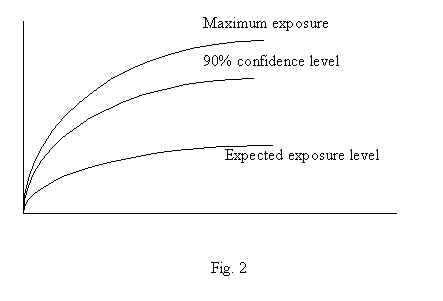

The derivative user must consider two exposure measures - maximum and expected. Knowing the maximum exposure gives a good point of comparison to the current exposure. If the maximum exposure approaches or exceeds the expected exposure, the firm should examine the events that are happening to determine if action is needed. Expected exposure gives a feel for the amount the firm could expect to lose on average.

Individual Transaction Exposure

Worst-Case Approach

This approach assumes that the situation moves to the maximum exposure and default occurs immediately.

Simulation Approach

This approach uses Monte Carlo simulation to generate random outcomes for the underlying to assess the degree to which the firm is exposed to financial price risk.

Option Valuation Approach

This approach views default as an option and analysis it accordingly.

Measuring Portfolio Exposure

As with loans, portfolio effects exist so that the exposure of the sum is less than the sum of the individual exposures. Default on derivative contracts are more idiosyncratic than default on a loan. Because default is more idiosyncratic for derivatives, the portfolio effect is more pronounced for derivatives than for loans.

A Swap vs a Loan

1. The principal in the swap is not at risk, it is only notional. But with a loan a big part of the credit risk has to do with failure to repay the principal.

2. In a swap the net payments (cash flow) are proportional to the difference in rates i.e. fix vs floating interest rates. But with a loan periodic cash flows to be paid or received is determined by the level of rates.

3. Default on a swap requires both that the party to the swap be in financial distress and that the remaining value on the contract be negative. Thus, the probability of default is a joint probability. But, with a loan default only requires that the firm be in financial distress.

Most dealers manage a portfolio of derivatives. It is not appropriate to simply add the exposures on all transactions because many of them will offset. Some transactions are offsetting with each party, others do not have the same timing of cash flows and all will not default at the same time. The primary way in which this risk is managed is by netting, the process of offsetting certain transactions. When two parties are involved, it is called bilateral netting.

Netting by Novation

Multiple transactions between two parties with the same underlying and the same settlement dates.

Closeout Netting

In the event of default, all contracts between two parties are netted in the sense that the amount owed reflects the difference in the positive and negative valued contracts to a particular party. These transactions do not have to have the same settlement dates but must be on the same underlying.

Cross-Product Netting

Transactions on different underlying are netted in there is a default.

Bilateral Netting

Netting the positions between different client accounts.

Risk Management in Practice

Impact of Netting on the Exposure to a Swap Portfolio

The biggest problem with netting has been the legal enforceability. Progress has been made in this area. With so many transactions transcending country boarders, the issues are complex, particularly when banks domiciled in one country maintain branches in another.

Measuring the Probability of Default

The probability of default is determined by the credit worthiness of the counterparty, the maturity of the transaction, the counterparty's exposure to movements in the underlying and the volatility of the underlying.

Methods for Reducing Credit Risk

Collateral

The amount posted is determined by the mark-to-market value of

the transaction. Sometimes only the party with the negative value

posts collateral. Sometimes, the lower credit worthy counter

party must post at all times. Sometimes there are trigger points,

such as a credit downgrade.

Third-Party Supports

Such as letters of credit from third a party bank.

Marking-to-Market

Increasingly, parties are marking their transactions to market on

a regular basis. In this case one party paying the other the

market value and then having the transaction reset to the current

market price.

Settlements, Unwinds, Assignments

The parties agree in the initial contract that if the exposure

reaches a certain threshold, they will settle up at that point

unwound or assigned to a third party.

SPVs

Many dealer firms have created subsidiaries that are structured

so as to have higher credit ratings than the dealers themselves.

This has the effect of separating the dealers primary business

from its derivative business. These subsidiaries have large

amounts of capital and undertake either offsetting transactions

or other measures to virtually eliminate credit risk.

Settlement Risks

The settlement process itself, in which parties pay off their obligations, is a source of risk itself. Payments occur at different times, particularly in international transactions. Also, most transactions do not terminate and settle on the same day. Netting reduces but does not eliminate settlement risk.