Managing Financial Risk, Smithson & Smith

Chapter 11

Using Swaps to Manage Financial Price Risks

by: Mark Glitto

Swaps are widely used to manage the nature of assets and liabilities that appear in corporate balance sheets.

Using Swaps to Reduce Funding Costs

There are three broad areas in which corporations employ swaps to modify their debt.

Acting on a View

Swaps are used to take a view of the level of interest rates or the shape of the term structure.

Examples:

In July of 1993 McDonald's Corporation secured the historically low fixed rate US dollar funds by issuing 200 million in 40-year bonds in the US. In order to take advantage of further reductions in interest rates McDonald's swapped 100 million of the bonds into 5-year floating rate debt and the other 100 million into seven--year floating debt.

Result: as interest rates declined further the swaps reduced the interest cost on the bond in excess of 200 basis points. McDonalds now has the opportunity to enter into another swap to permanently lock in the lower interest rates.

In September 1992 McDonalds felt that UK interest rates were going to fall. In four transactions McDonalds swapped 60 million of fixed-rate pound sterling liabilities into 3-year and 5-year floating rate liabilities on which they had been paying approximately 9 percent fixed.

Result: Interest rates did decline and McDonalds ended up paying about 6 percent floating.

This gives McDonalds the opportunity to re-fix the debt at almost 300 bases points below the original rate.

Note: If a firm has a view that the term structure may shift, say to favor long term debt, the firm can exploit this by swapping from a short term rate into a long term rate.

"Arbitraging" the Markets

Although we don't find textbook examples of riskless arbitrage, the simultaneous buying and selling to earn riskless profits, swaps are used to take advantage of unequal taxes or regulatory treatment in different countries.

Example:

In 1990 there arose a situation were there was asymmetric tax treatment for issuing debt in New Zealand vs the US. McDonalds along with other corporations took advantage of this and "arbitraged" the difference. McDonalds borrowed below the market rate issuing 100 million in New Zealand dollar bonds. 25 million of this financing went into funding its New Zealand operations. 50 million of the New Zealand dollars were swapped into US dollars enabling McDonalds to achieve funding 11 basis points below McDonalds commercial paper rate. The remaining 25 million was converted into dollars immediately.

Reducing Transaction Costs

Swaps are very efficient devices. This efficiency helps reduce costs.

The alternative to a swap transaction for McDonalds to adjust their fixed-rate to floating-rate debt would be to issue new floating-rate debt and then use the proceeds to call or repurchase their fixed-rate bonds. This alternative to a swap could be so costly and time consuming as to make the transaction impractical.

Borrowing domestically and doing a currency swap may be cheaper than borrowing in the foreign country, even though the effective borrowing rate is the same.

BUT WATCH OUT: When swaps are used they create credit risk, a new risk that did not exist before. Thus, any savings from the swap can be offset by the additional risk that is taken on.

Using Swaps to Increase Debt Capacity

We have seen how derivatives in general and swaps specifically can be used to reduce risk. A firm that has less risk is able to support more debt.

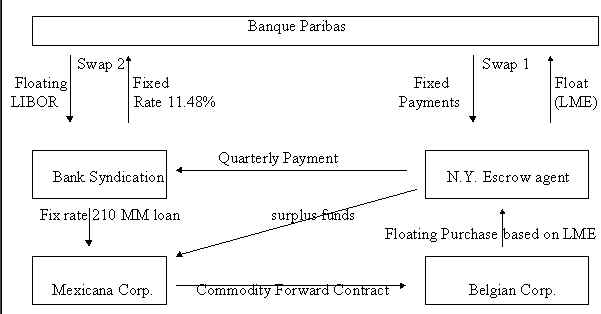

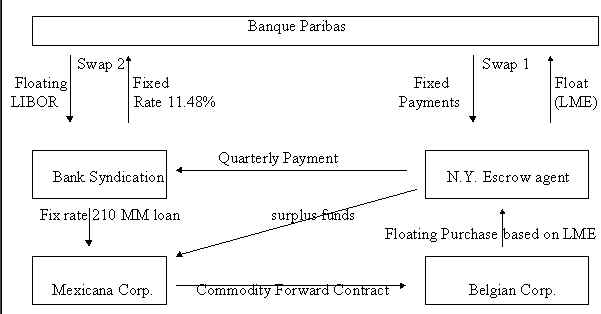

Mexicana de Cobre

Facts

Mexicana requires $210 million in fixed rate funding from foreign banks.

Three Problems

The bank financing syndication faces three problems: First, political risk, the possibility that the foreign corporation, Mexicana, will default on loan due to lack of business or because it simply refused to make scheduled payments. Second, payment or credit risk (risk that cooper prices fall). Finally, the banking syndicate desires a floating rate asset as opposed to the fixed rate funding Mexicana needs.

Steps to Resolve the Problems

1. Political Risk: A forward sale of cooper is arranged between Mexicana and a Belgian consumer of cooper. The Belgian company agrees to purchase a fixed amount of cooper per month at the floating rate as set by the LME (London Metal Exchange) price of cooper. The Belgian payments go into an escrow account in New York. This is a legal contract were a written instrument or money is temporarily deposited with a neutral third party. The escrow agent holds the instrument until conditions of the contract are meet. In this case the escrow agent receives the floating payment from the sale of cooper. The agent then pays out the quarterly loan payments directly to the bank syndicate. Any surplus in escrow is periodically paid directly to Mexicana. This reduces the political risk.

2. Cooper Price Risk: Enter into a commodity swap between the escrow account and Banque Paribus. The escrow account makes floating payments based on the LME (London Metal Exchange) price of cooper and receives a fixed rate amount. The length and cash flows of this swap conform to the length and payment dates of the bank syndicates loan. The fix rate is set at 10% over the required monthly loan payment. This transfers the cooper price risk from Mexicana and the bank syndicate to Banque Paribas.

Results: Financial risk management allows businesses to minimize risks and shift risks to other parties. By stabilizing company value, Mexicana can convince lenders that it is sound and thus increase its ability to borrow funds. If the political and commodity risks were not shifted away from the bank syndication, the lenders would not have been able to make the loan. Once these risks were dealt with, the remaining risk in making the loan is the business risk inherent in the mining operation.

Government Use of Swaps

The U.S. government does not use swaps, but state and local governments do. Transportation authorities frequently use swaps to lock in energy prices. Because of fixed revenue from their tax basis and the inability to change (raise) prices as easily as corporate entities, it is important for government agencies to lock in there yearly costs. Using swaps to lock in energy costs allows governments certainty in providing services with budget constraints.